11 July, 2017 By: Rebecca Martin

With driverless cars and wearable devices tipped to protect us from unforseen circumstances, the way we insure ourselves is also going to change. What might insurance look like for future you?

What do David Beckham’s legs, a wedding, a storm and a hole in one all have in common?

No, it is not the plot for a slapstick comedy (although it could be).

You can either insure them (legs, wedding) or insure against them (storm, hole in one).

Interesting, right? Which is not typically how you would explain insurance.However, if you poke around a little, you’ll actually find that having been around for more than 250 years, the insurance industry has learnt to be remarkably adaptive and innovative to move with the times.

It’s about to happen again.

New technologies – like driverless vehicles, smart homes, artificial intelligence and blockchain technology – are tipped to change both what and how you insure. In the future, car insurance could be paid only as you drive, health and life insurance premiums could be calculated via a smart device and claims would be instant - no calls, emails or visits to branch offices.

The many potential scenarios are exercising the minds of insurance executives worldwide. Why? Because as John Stringer, Chief Executive Officer of RAC Insurance and 40-year veteran of the industry says, what the predicted disruptive change will look like for customers and insurers is still very much conjecture.

“There are a lot of questions that we don’t have the answers to,” says Stringer.

“We know driverless cars are coming and that they’ll raise lots of questions, like who’s responsible in a crash, but how soon?

“And as we don’t yet have any customers with driverless cars, we can only anticipate for now how that change will play out.

“What we do know from experience is how quickly things can change. The mobile phone is a good example of how technology can quickly become widespread – even ten years ago many people didn’t have one. Today you don’t leave home without it and it’s your computer.

“So we know we need to be ready. The trick for insurers is to work through these future scenarios and prepare so when our customers do start asking for these things, we can offer them what they want and need.”

What might insurance look like for ‘future you’?

With new technologies coming along fast, here’s a breakdown of what your insurance might look like in the future…

Insuring people rather than objects

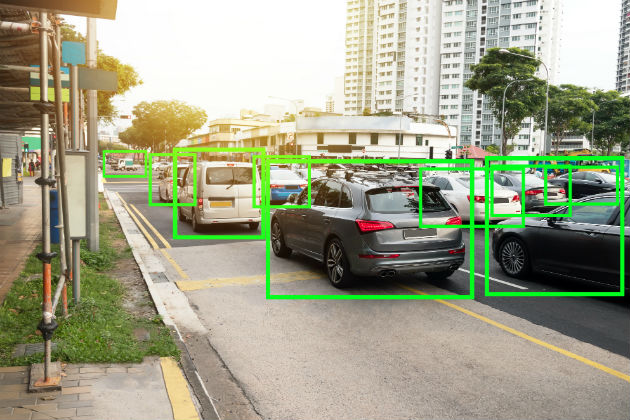

Technology – driverless vehicles

Look mum no hands might have once been a by word for missing front teeth, but not anymore. With driverless technology tipped to reduce human error behind the wheel, the risk of you getting into a bingle will massively drop.

And with many cities trialling transport alternatives such as car sharing, it’s expected that private car ownership levels will also drop.

“If you don’t own a car, you don’t need car insurance,” says Stringer.

“Even if you do own a car, if it uses safer technology, your risk of crashing decreases. With lower risk, come lower premiums.

“So it may mean that in the future, you are less likely to buy car insurance, or you might buy a lower level of insurance, but buy more personal insurance for yourself. In other words, you insure against something generally going wrong when travelling rather than just when driving a car.”

Highly personalised insurance

Technologies: Internet of Things (IoT)

You know those smart watches and fitbits that track movement, heart rate and the number of steps you take in a day? They’re just a tiny speck in the much larger world of data collection that can happen via a device, your connected home or car, currently broadly termed the Internet of Things (IoT).

The data collected by your IOT devices could allow for very personalised insurance as insurance companies could use that data to better they can evaluate your risk profile and tweak your premiums.

For example, if you park your car in a locked garage every night, data coming from the automatic garage door would show that and your car premiums may be lower.Likewise, data obtained by your smart watch about your excellent health could result in better health and life insurance premiums.

Enjoying this article?

Sign up to our monthly enews

The IOT devices could also help mitigate risks. Imagine you started to get seriously sick, racing heart, fluctuating temperature. Your smart watch could pick the early signs and recommend you get medical help, reducing the severity (and therefore potential claim) of your illness.

A connected smart home could work in the same way. Got a leak from your hot water system? The system would send an alert letting you and your insurer know, reducing the damage and fast-tracking your house insurance claim.

Stringer says although the technology sounds ‘big brother’, he expects its use will be dictated by consumers, not insurers.

"We know some people are going to be completely fine with sharing that kind of personal information. They don’t mind living ‘publicly’. We also know a large segment of the market that is more private and will not be comfortable providing access to that kind of information."

“We need to appeal to all customers, so we’ll need to tailor our products to suit both those ‘public’ and ‘private’ preferences, plus probably a third category that like you knowing a little, but not everything.”

Instant claims

Technology: Blockchain and artificial intelligence

One big change with insurance over the past decade is how much digital technology has sped up the insurance process, from buying a policy to paying a claim.

“Ten years ago, right across the insurance industry, it took a lot longer to get a claim paid out as it was a very manual process,” says Stringer.

“If a fence blew over we would send someone to assess the fence, get quotes and in the end, go through a long and difficult process to pay out for damage to two panels.

“But very quickly, we’ve been able to use better technology and data to speed that process up.

"Today, if your fence blows over, we just ask how many panels. We know the approximate cost, so without getting quotes, we just transfer the money direct to your account. You can buy your policy online, enter your claim online and the money turns up in your bank very quickly. It’s been a huge move forward."

After digitisation comes automation, where the claims process could happen with very little, or even no human intervention.

Blockchain, a new technology that works as a secure digital ledger of any agreement, is seen to hold the greatest promise for consumers.

Because blockchain technology can hold the encrypted terms of your insurance policy it could automatically pay your claim. For example, if you had travel insurance cover for cancelled flights, the digital ledger would pick up that that airline’s flight had been cancelled, note that the conditions of your insurance agreement has been met and automatically send your claim payout.

Artificial intelligence (AI) is another new technology likely to play a role in automating parts of the claims processing. As the amount of data around risks and claims grows, AI technology could use that data to process your claim instantly.

“No-one can predict the future but the one thing we do know is that with all this technology, it’s clear change is on its way,” says Stringer.

“And given the amount of work that is being put into predicting and preparing to meet the needs of our customers by us and many others, I’m looking forward to seeing how it pans out, not just for the insurance industry, but for the way we all live. We live in exciting times.”

We've been insuring WA for 70 years!!

That's right. 70 years of looking after Western Australians and the things that matter to them. We're looking forward to the next 70 and navigating the changes new technologies bring for the better of our members.